Your shopping cart is empty!

Welcome visitor you can login or create an account.

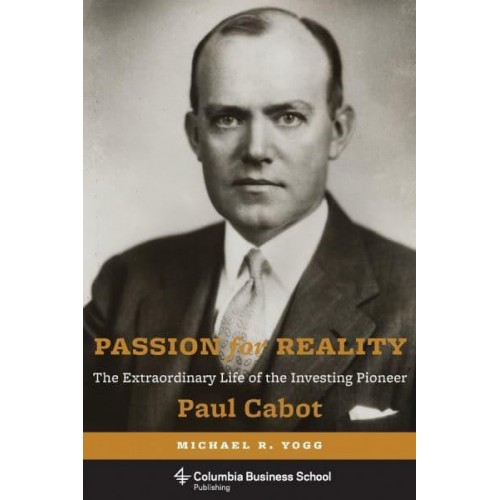

Passion for Reality The Extraordinary Life of the Investing Pioneer Paul Cabot

Publisher: Columbia University Press

Author: Michael R. Yogg

$30.73

Publisher:

Columbia University PressAuthor:

Michael R. Yogg Paul Cabot (1898-1994) was an innovative mutual fund manager and executive known for his strong character, charismatic personality, and trendsetting financial achievements. Iconoclastic and rebellious, Cabot broke free from the Boston Brahmin trustee mold to pursue new ways of investing and serving investment clients.Cabot founded one of the first mutual funds-State Street Investment Corporation-in the early 1920s, campaigned against the corrupt practices of certain other funds in the late 1920s, and lobbied on behalf of key New Deal securities legislation in the 1930s. As Harvard University treasurer, he increased the allocation of the endowment to equities just in time for the bull market of the 1950s, and as a corporate director in the 1960s he campaigned against conglomerates' abusive takeover strategies.Having spent nearly two decades working for Cabot's company, State Street Research & Management, as an analyst, research director, portfolio manager, and chief investment officer, Michael R. Yogg is well positioned to share the secrets behind Cabot's extraordinary success and relate the life of an extraordinary man. Cabot pioneered the use of fundamental stock analysis and was likely the first to take up the progressive practice of interviewing company managements. His accomplishments all stemmed from his passion for facts, finance, and creative thinking, as well as his unbreakable will, facets Yogg illuminates through privileged access to Cabot's papers and a wealth of interviews.

| ISBN: | 9780231167468 |

| Publisher: | Columbia University Press |

| Imprint: | Columbia Business School Publishing |

| Published date: | 18 Feb 2014 |

| DEWEY: | 332.6092 |

| DEWEY edition: | 23 |

| Language: | English |

| Number of pages: | xxiii, 263 |

| Weight: | 526g |

| Height: | 236mm |

| Width: | 152mm |

| Spine width: | 22mm |

Write a review

Your Name:Your Review: Note: HTML is not translated!

Rating: Bad Good

Enter the code in the box below:

Discount

$131.92 $127.98